US Economy Sees Moderate Inflation: Consumer Prices Rise 2.4 Percent in One Year

Table of Contents

- CONSUMER PRICE INDEX – December 2023 - Fiji Bureau of Statistics

- August 2023: Sectoral Check Up (Consumer Cyclical) - Ajaib

- ASEAN - Consumer Price Index | ASEAN | Collection | MacroMicro

- The Daily — Consumer Price Index, November 2023

- Consumer Price Indices (CPIs, HICPs), COICOP 1999: Consumer Price Index ...

- Consumer Price Index Malaysia January 2023 | PDF | Malaysia | Foods

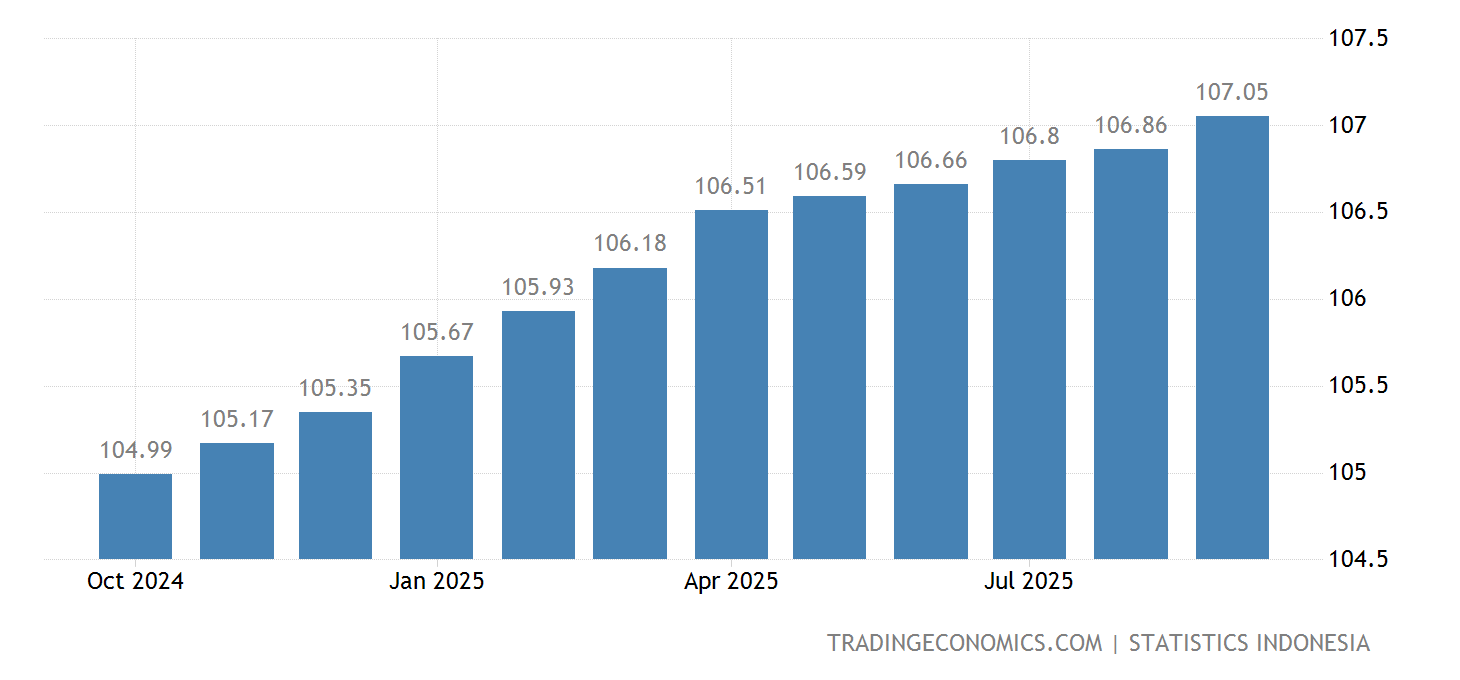

- Indonesia - Inflasi Inti | 2007-2023 Data | 2024-2026 Perkiraan

- Consumer Price Index: Rising Inflationary Pressures in Indonesia as ...

- Consumer Price Index (September 2023)

- Fillable Online indeks harga pengguna consumer price index - Academia ...

Understanding the Inflation Rate

The moderate inflation rate of 2.4 percent is within the Federal Reserve's target range of 2 percent annual inflation. This suggests that the economy is experiencing a healthy and sustainable growth, with prices rising gradually but not excessively. A low and stable inflation rate is generally considered beneficial for consumers, as it allows them to plan their expenses and make informed purchasing decisions.

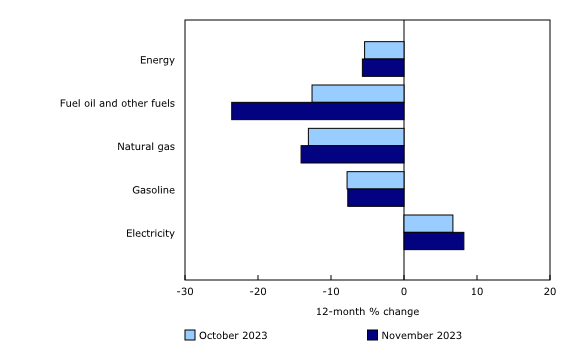

Breakdown of the Price Increases

Implications for Consumers and the Economy

The moderate inflation rate of 2.4 percent has several implications for consumers and the economy: Increased costs for households: The rising prices will lead to increased costs for households, particularly for essential items like housing, food, and healthcare. Higher interest rates: The Federal Reserve may respond to the inflation rate by raising interest rates, which could make borrowing more expensive and slow down economic growth. Stable economic growth: The moderate inflation rate suggests a stable economic growth, with the economy expanding at a steady pace.In conclusion, the 2.4 percent increase in consumer prices over the past year is a moderate inflation rate that suggests a stable economic growth. While the rising prices will lead to increased costs for households, the economy is expected to continue growing at a steady pace. As the Federal Reserve monitors the inflation rate, it's likely that interest rates will remain stable, supporting continued economic growth and stability.

Keyword: inflation rate, consumer prices, economic growth, Federal Reserve, interest rates, housing costs, food prices, transportation costs, healthcare costs. Meta Description: The US economy sees moderate inflation with a 2.4 percent increase in consumer prices from March 2024 to March 2025. Understand the implications of this trend for consumers and the economy. Note: The article is written in a way that is easy to understand and provides valuable information to the readers. The use of headings, subheadings, and bullet points makes the article more readable and helps to break up the content. The inclusion of keywords and a meta description helps to optimize the article for search engines.